Closing Costs in Atlanta, GA

What are Closing Costs?

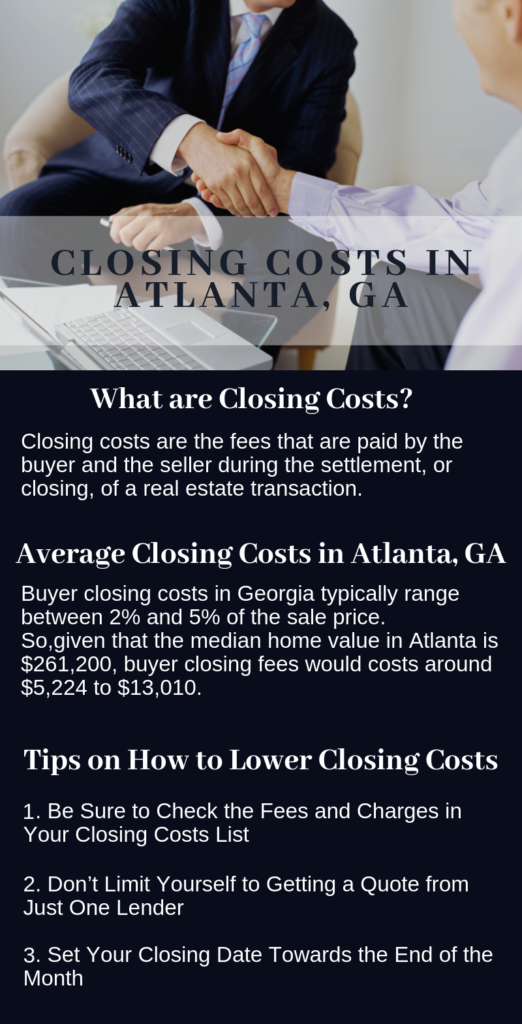

During the settlement, also called closing, of a real estate transaction, there are fees and charges that are paid by the buyer and the seller to parties that provided their assistance and services throughout this process. These expenses are what we call closing costs. Generally, most of the closing costs are the responsibility of the buyer, but laws and customs vary from state to state. Whether you are a first time homebuyer or not, it would benefit you to work with a real estate professional so that you can be given the guidance that you need in order to get the best deal out of this transaction.

Average Closing Costs in Atlanta, GA

Common Closing Costs for Georgia Home Buyers

Buyer closing costs in Georgia typically range between 2% and 5% of the sale price. So, given that the median home value in Atlanta is $261,200, buyer closing fees would costs around $5,224 to $13,010. It is important to note that your closing costs will be determined mostly by your lender’s requirements and the value and condition of the property that you are buying. Also, in Georgia, an attorney is required to review all the settlement documents and sign off on real estate transactions at closing. Attorneys usually charge about $721 for this service.

One of the closing costs buyers will be responsible for is the appraisal fee, which is around $333 on average. Buyers are required by lenders to hire a professional appraiser to value the property to protect both the financial institution’s investment and ensure that the homebuyer is paying fair market value. A home inspection is not a mandatory service in this state, but it is best to have this performed to avoid any serious issues that may cost you more in the future.

Discount points are fees paid directly to the lender at closing to lower your monthly mortgage payments. One discount point usually costs 1% of your home loan. For a $200,000 loan with a rate of 4.5%, buying two points can reduce this to 4%, resulting in a monthly savings of $58.54. You will also be required to pay your lender a fee to process your loan application.

Real estate transfer taxes generally cost $1.00 per thousand (plus $0.10/hundred) based upon the value of the property. Although these are usually the responsibility of the seller, it is commonly passed on to the buyer during negotiations. Title insurance policies, such as lender’s title insurance and owner’s title insurance are also typically paid by the buyer. Intangibles tax of $1.50 per $500 based on the amount of the loan is required to be paid by the buyer within 90 days, as well as a $10.00 tax in accordance with the Georgia Residential Mortgage Act.

Common Closing Costs for Georgia Home Sellers

In metro Atlanta, where the median price of a house is $250,000, sellers can expect to pay $11,346 in closing costs. Sellers are responsible for the real estate agent’s commission, which costs around 5% to 6% of the home’s final sales price. Another cost for sellers is the pro-rated property taxes from January 1st until the settlement date of the home sale. So, if the closing date is July 31st, then the seller would be responsible for property taxes from the start of the year to the end of July.

State and county real estate transfer taxes are also the responsibility of the seller. According to the State of Georgia’s Department of Revenue site, “The real estate transfer tax is based upon the property’s sale price at the rate of $1 for the first $1,000 or fractional part of $1,000 and at the rate of 10 cents for each additional $100 or fractional part of $100…The seller is liable for the real estate transfer tax, though frequently the parties agree in the sales contract that the buyer will pay the tax.”

Breakdown of Closing Costs in Atlanta, GA

- Appraisal Fee

- Application Fee

- Attorney Fees

- Home Inspection

- Discount Points

- Title Fees

- Title Insurance

- Down Payment

- Transfer Taxes

- Property Taxes

- Pro-rated Property Taxes

- Pro-rated Real Estate Transfer Taxes

How Can a Homebuyer in Atlanta, GA Lower Their Closing Costs?

Although the list of buyer’s closing costs can be quite daunting, especially to first time homebuyers, most of these expenses are not set in stone and buyers can negotiate with the seller to cover some of them. You can also talk to your lender to lower or remove some of the costs. Here are a few more ways you can significantly reduce your closing costs:

1. Be Thorough When Checking the Fees and Charges in Your Closing Costs List

One of the biggest mistakes most homebuyers make is neglecting to check their list of closing costs. But by taking the time to thoroughly go through this list and familiarizing yourself with each item, you can significantly reduce your closing costs. There may be some items that are listed twice with different terms or some items that are vague which you can ask your lender to take off the list.

2. Get a Quote from More Than One Lender

A recent study shows that homebuyers can save as much as $1,500 by getting a second quote and at least $3,000 if they get quotes from five different lenders. When you take the time to shop around for lenders, you can save one-eighth percent to a half-percent of your loan. These may seem small, but if you compute the half-percent interest on a $500,000 loan, this amounts to a significant annual savings of around $2,500.

3. Schedule Your Closing Date Towards the End of the Month

Setting the closing date towards the end of the month can greatly reduce your prepaid daily insurance charges, as this decreases the number of days between the settlement date and the succeeding month. In effect, your prepaid or “per diem” interest will be lower. If you want to compute for your savings, multiply your loan amount by your interest rate then divide the result by 365 to get your daily interest charge. Next, multiply that amount by the number of days left in the month. The result will be the amount that you will be paying at your closing meeting.

If you are in search of the perfect home in Atlanta, GA for you and your family, I can help. Feel free to give me a call at 678-442-1509 or send me an email at info@AtlantaDreamLiving.com to schedule a meeting!